AP Office Announcements

RSS Feed Page

e-IDT Funding & GL Changes – New Procedures (120922A)

An enhancement has been made to the e-IDT process to provide an efficient method for making changes on P-card transactions. Funding changes can be made on any P-card expense, but P-card GL changes are not allowed unless related to an expense with grant funding.

However, if you have a GL correction for a P-card charge that is required due to policy, contact Accounts Payable at payables@txstate.edu for assistance. AP will need to process a JV entry for this type of correction if the GL change is approved.

Key points related to this change are:

- Use the P-card, Grant GL, & Large Document Correction Procedures for P-card funding changes as it is the only way to efficiently change funding on a P-card transaction. A P-card document contains hundreds of lines, so this process streamlines the funding change process to just a single charge (or up to 10) you want to change. It is only necessary to enter those lines rather than all lines in the SAP document.

- Use this process for funding changes on other SAP document types with 10 or fewer lines.

- For documents with more than 10 lines, email financialreporting@txstate.edu for assistance.

- P-card transaction GLs cannot be changed via the new funding/GL change procedures unless a grant fund is involved.

- GL changes on a P-card charge should never be needed unless the GL is incorrect per policy requirements. If that occurs, please contact payables@txstate.edu for assistance. As P-card GLs are pre-assigned, this type of change should be very rare.

- GL changes not related to P-card transactions can be done using the original e-IDT Procedures.

Commonly Used GLs Updates (112321A)

The Commonly Used GLs listing has been updated with additional examples to help aid selection of the correct GL number for Purchase Requisitions and e-NPOs.

There is also a new resource, Contracted Services GLs, available for your use and reference. This information will assist with determining the correct GL for these types of services.

These and the other GL listings are available on the Accounts Payable GL Codes page.

GR Email Suspension (102521A)

Financial Services has partnered with Technology Resources to enhance the departmental goods receipt process available through SAP transaction Z_MIGO.

Currently, 10 days from invoice entry by Accounts Payable on a Purchase Order, departments receive automated email notifications to enter a goods receipt for items delivered directly to their unit. During the shipping/delivery process, delivery may be delayed or mishaps may occur, such as the item is damaged, out of stock, installation is pending, or the wrong item was shipped. Departments can now alert Accounts Payable of the issue to temporarily suspend goods receipt emails while pending resolution.

Example:

The item ordered below was damaged and the department identified 11/13/2021 as the new estimated delivery date. Emails reminding the department to enter a goods receipt will be suspended until 11/13/2021.

If the estimated delivery date needs to be extended, the department can update it by accessing the document number again.

By providing this functionality, the department alerts Accounts Payable that there is an issue and subsequent reminder emails will not resume until the anticipated delivery date. This will save time for departments, Central Receiving, and Accounts Payable while waiting for items to be received or issues resolved.

Student Vendor Numbers (101321A)

Some students may have multiple vendor numbers, as detailed below. Please review to familiarize yourself with the appropriate use of each.

"3" Vendor Numbers

- Each student worker has an employee vendor number beginning with "3".

- Use this number to submit reimbursements for work-related expenses (e.g. office materials, conferences, etc.).

- Reimbursements to "3" vendor numbers are not IRS 1099 reportable.

"5" Vendor Numbers

- Payments to students who are not student workers require a vendor number beginning with "5". The only exception is if the generic vendor number, 700001, can be used for a reimbursement or refund.

- Use this number to submit reimbursements to student workers for non-degree or non-work related expenses, which very rarely occur.

- Payments to students for degree-related expenses must first be submitted to Financial Aid for review. If determined it is not scholarship eligible, you will be directed to AP for payment.

- To avoid reimbursement delays, be sure to attach the Financial Aid response to the e-NPO payment request.

- Payments to "5" vendor numbers will be reported to the IRS 1099, if required.

Training and Tuition GLs – Text Descriptions (082721A)

The university is required to complete an annual report for the State of Texas listing any employee who received $5,000 or more for a training course, certification course, or employee tuition paid by the university. The Accounts Payable and Travel Office will identify reportable employee training costs and complete the report.

SAP data from select text fields can provide the information for the report. To ensure there is accurate information in SAP and make this reporting process efficient, campus staff must follow these requirements for the Short Text Field content on Purchase Requisitions (PRs) for GLs 720300 (in person training) and 724300 (virtual training for employees or students):

- The PR cannot be LOCAL, but must be Framework and the GR flags need to be removed.

- The PR Short Text Field must state: Employee’s name and training/certification title. There are 40 digits, including spaces, in this field.

- If the PR is for more than one employee, list both employee names and the training/certification title. The first initial and last name can be used to save space, allowing the data to be entered. The employee’s name data should be entered first in the field followed by the course title.

- If employees and students are registered for the course, list the number of attendees and the cost per attendee. You can also attach a summary document to the PR with a complete breakout.

- NOTE: Use GL 721300 for student only training (in person or virtual).

For e-NPOs, the same text comments on what, who, and how many are attending will be placed in the Business Purpose of the Payment Field. This field has 65 digits and, again, the employee’s name info should be entered first followed by the course title.

If the text fields for PRs or e-NPOs are not completed as stated above, Procurement (for PRs) and AP (for e-NPOs) will reject the item back to the creator for correction on the text data.

- If a P-card waiver is requested from Procurement to pay for a training or certification course, it must clearly state what the training/certification is for, who (or how many) are attending, and the cost per individual. If the department doesn’t provide the correct information, the waiver will not be approved until it is corrected.

GL 720200 (employee tuition) is not processed using a PR, but the description requirements are the same as above for e-NPOs and P-card waivers. To avoid payment delays, ensure the e-NPO Business Purpose of the Payment Field or the P-card waiver information is complete.

Inter-Departmental Transfer (IDT) Program (082521A)

Electronic Inter-Departmental Transfers (e-IDTs) are used when transactions are conducted between university departments and agencies processed through Texas State’s accounting system. The process is also used to correct expense payments to the incorrect general ledger number or funding source (e.g., fund, cost center or internal order).

To review the e-IDT procedures and account manager approval guide, please visit the Forms & Resources page on the Financial Reporting and Analysis website.

Inquiries and questions regarding e-IDTs should be directed to financialreporting@txstate.edu.

General Ledger Number Guide (070821A)

The Accounts Payable and Purchasing offices have coordinated to create a quick informational guide to assist campus staff in selecting the correct General Ledger (GL) number when creating Purchase Requisitions (PR) and e-NPOs.

This guide includes:

- Why it is important to select the correct GL.

- The resources available to assist in selecting the correct GL.

- Things to keep in mind when creating a PR or e-NPO.

- Tips for consistently selecting the correct GL.

To review the General Ledger Number Reference Guide - What You Need to Know, please visit the GL Codes webpage.

Commonly Used GLs (030821A)

Please be advised that there are new resources available for your use and reference on the Accounts Payable GL Codes page:

-

Assets Commonly Used GLs (new)

-

IT Commonly Used GLs (new)

-

AP Commonly Used GLs (updated)

Invoice Contact Information on TSUS Marketplace Orders (110414A)

At the last BOBCATBuyers meeting, we discussed the issue of identifying the correct routing for emails from AP concerning Goods Receipts or Account Manager approval. Below is an explanation of how internal notes and attachments can be used to identify the correct departmental contact.

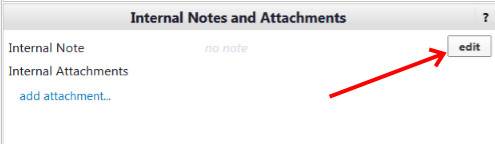

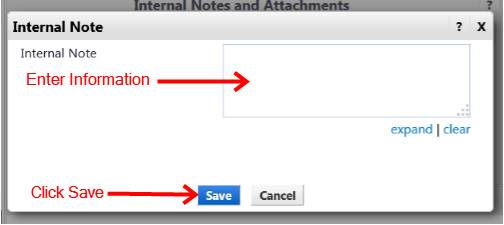

On a TSUS Marketplace Purchase Requisition, enter the contact person’s name, netID and telephone extension in the Internal Note field after you have proceeded to checkout. The Internal Note area is located under the accounting information area on the left hand side. Click on the “edit” button.

A dialog box will come up. Enter the information and click on the “Save” button.

The Internal Note field is only viewed internally and doesn’t show on the PO. AP will check the Internal Note field for routing invoices requiring approval or action (Goods Receipt).

Offsite and Webinar Training Expense GLs (103020A)

As a result of COVID-19, many training conferences and seminars have moved to a webinar format. That change has created some confusion regarding which GL to use for training registration fees.

Employee Training GLs

- If the seminar or conference takes place off site, the correct GL is 720300 – Registration Fees Employee Training.

- If training occurs via webinar (virtual), the correct GL is 724300 – Education/Training Services.

Student Training GLs

- If the payment is for training conducted by a contractor (e.g. Lecturer) for a group of students, the correct GL is 725200 whether for in person or virtual training. This type of training expense for students is typically related to a degree requirement.

- If a student is attending a conference not required for a degree, the correct GL is 721300 whether in person or virtual training.

These distinctions have been stated on the AP Commonly Used GLs listing for many years and were taken from the State of Texas Comptrollers GL listing/descriptions.

If you create any purchase requisitions or e-NPOs for these types of training options, be sure to use the correct GL to avoid a delay in payment. If GL 720300 is used on an e-NPO for employee training webinars, AP will be unable to correct the GL to 724300 because this GL routes to Procurement for approval in the e-NPO workflow. The same is true when GL 721300 has to be changed to 725200 for student training involving a lecturer. Remember, the e-NPO workflow will restart if you have to change the GL.

Comptroller GL Lookup Instructions and SAP GL Listing (062320A)

Please be advised that there are two new resources available for your use and reference on the Accounts Payable GL Codes page:

- Instructions for looking up GL numbers on the Comptroller’s website, and

- The full SAP GL Listing (updated quarterly).

AP e-NPO CHECKLISTS (050820A)

The Accounts Payable office has created an informative checklist for processing e-NPOs. It is encouraged to reference the correct checklist when creating an e-NPO for efficient payment processing.

Access the e-NPOs Checklist page directly by selecting the Resources tab on the Accounts Payable website or via the AP e-NPO Procedures page.

AP Resources Web Update (050420A)

The AP Resources webpage has been updated. New Disputing an Invoice procedures have been posted and should be referenced when a dispute is necessary on a vendor invoice.

GL Numbers for Purchase of Blinds (041520A)

When purchasing blinds, there are two GL numbers that could be used depending on the reason for the purchase. The purchase price for the blinds must be under $5K as the GL accounts are not used for capital items. The GL’s are defined below with an explanation of when to use each GL.

733400 – Furnishing/Equipment

- Use when blinds are purchased without being related to a specific project or renovation and the cost is less than $5K.

726600 – Real Property Bldgs/Maint/Repair Expensed

- Use when blinds are purchased related to a renovation or maintenance project. This includes when a contractor is hired to purchase and install (labor) the blinds.

The AP Commonly Used GLs list is available for use GL Codes on the AP website. Please reference this website when creating any Purchase Requisition if you are unsure of the correct GL to use for the item you are purchasing.

Research Advance Repayment Option (040620A)

The TouchNET System can now be used to repay unused research advance funds and the Research Cash Advance – Return of Unused Funds website is accessible from anywhere. It is no longer necessary to trek to JCK to deposit the funds at the Cashier’s Office!

With this process, there is also no need to enter the General Ledger Number or Fund Number as these are programmed into the TouchNET System on the website presented above. You will need to enter your bank routing number, bank account number, and the 10-digit Funds Commitment Number (starts with 29) assigned to the cash advance. Enter the required information into the fields provided and ensure the return amount and Funds Commitment Number are correct.

Upon receipt of your payment confirmation email, please retain a copy for your records and attach a copy to your Advance Reconciliation to clear the advance.

Note that insufficient fund fees may apply, and you are responsible for such fees if your bank account does not have available funds when you process the return through this system. Be sure to check your bank account balance before you start this process in order to avoid insufficient fund fees.

e-NPO for Contractor Payments (040220A)

Please review the following regarding contractor payment for services and those that are to be reimbursed for travel expenses. Following these guidelines will help avoid unnecessary delays and reduce contacts back to the creator for clarification or supporting documentation.

- For e-NPOs related to an executed contract, include the contract number in the Comments section. PSS will use that number to reference the contract terms and the service fee amount. If travel is to be reimbursed, attach the page(s) of the contract to the e-NPO so the requirement is substantiated and verified by the Travel Office as allowed under the contact terms.

- For e-NPOs where there was no contract executed, attach the email correspondence with the vendor and their acceptance of the terms. The attachment must show what is included in the service fee or to be reimbursed (i.e. travel expenses are the only reimbursements allowed). The Travel Office will need that information to verify the reimbursement requirement.

- The GLs used for contracted services are located on the AP Resources - GL Codes webpage.

- If the e-NPO document is for contracted services only, the e-NPO will route to PSS for approval on the contracted services GL account and validation against the contract number provided or the agreement pages attached. PSS approval is required in the SAP Workflow for any contracted service payment.

- Note that contractor reimbursements for non-travel expenses should not be reimbursed. Contractors should provide their own equipment and supplies. This process is typical for straight contracted service payments and those in which the service fee includes any type of expense, including travel. The travel and other expense GLs would not be used on this e-NPO.

- If the e-NPO is for contracted services, references a Trip Number, and includes receipts for travel (use GL 725100 - Professional Services Travel Reimbursement), the e-NPO will first route to PSS.

- PSS will verify the contracted services amount and that the travel expenses are to be reimbursed and not included in the contractor’s service fee. PSS will approve the e-NPO document in workflow. If travel was to be included in the fee, PSS will reject the e-NPO, returning it to the creator for correction. Approval will not occur until the e-NPO is corrected and the travel line deleted.

- After PSS approves the e-NPO document, it will be routed to the AP and Travel Office for review and payment.

e-NPO Screen Changes – COVID-19 Tracking (032720A)

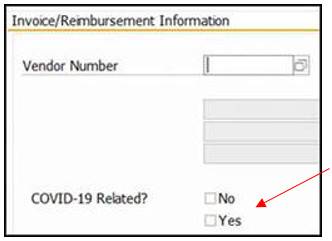

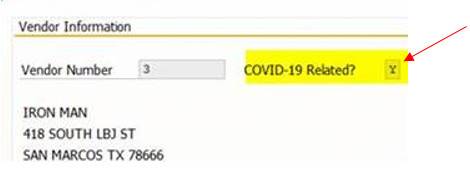

Effective today, when creating an e-NPO, you must select ‘Yes’ or ‘No’ as shown below indicating if the expense captured on the e-NPO is related to COVID-19 or not. The new requirement fields are directly under the Vendor Number section on the e-NPO screen.

When creating the e-NPO document, you cannot combine COVID-19 with other business expenses; they must be on separate e-NPO documents. This is because you cannot select both ‘Yes’ and ‘No’ on the e-NPO document. The expenses must either all be related to COVID-19 (select ‘Yes’) or not related to COVID-19 (select ‘No’). This new question is a required field, therefore, the e-NPO will not be able to be created without a selection. If no selection is entered, you will receive the following error message:

Approvers will see the selection when reviewing the e-NPO in workflow. It will show to the right of the Vendor Number on their screen (but it will not be highlighted as below, which was done for emphasis).

Shredding GL 752602 (121319A)

The correct GL to use for shredding on Purchase Requisitions or e-NPOs is 752602. This Shredding Expense GL includes destruction of paper documents, discs and hard drive destruction. Do not use any of the Contracted Services GLs or GL 752600. The AP GL Codes webpage has been updated with a new AP Commonly Used GLs list. Please reference this website when creating any Purchase Requisition if you are unsure of the correct GL to use for the item you are purchasing.

If you have any open POs for shredding and GL 752602 was not used, please correct those now so future invoices can be properly expensed and avoid any delays on the invoice payment.

Jason’s Deli (Vendor 6067) Invoice Process (101519A)

Please refer to the following guidelines when accepting deliveries from Jason’s Deli. It is important to follow this guide to ensure payment on invoices received from Jason’s Deli are processed in an efficient and timely manner.

- When the order is delivered, the campus staff will accept, sign and if appropriate, add a tip and write in the correct total amount for the invoice.

- Write the tip amount and adjusted invoice amount on the delivery persons copy as well.

- If you do not add a tip, “No Tip” should be written on the invoice that the delivery person retains and also write “No Tip” on your copy.

- Be sure to include the PO number on the invoice, also a list of attendees, business purpose, invoice received date, service completion date and approval. Email the invoice and required documentation to payables@txstate.edu.

Foreign Vendor Payments & Tax Consequences (092619A)

Please note that there may be tax consequences for foreign vendor payments which could affect the amount of cash actually paid to the vendor.

To start the payment process, verify the vendor is set up in PaymentWorks. This will ensure their information is correct and that the payment method is properly identified. Some vendors will accept a U.S. bank check, but many require wire transfer payments. If wire transfer is the preferred payment method, the information is required in PaymentWorks. You will not need to obtain an AP-03 Wire Transfer form if the vendor is in PaymentWorks. See the Vendor Self-Service webpage for links to PaymentWorks and instructions.

Payment via e-NPO

- Email the invoice to the Payroll & Tax Compliance Office (Tax Office) at taxspecialist@txstate.edu for their review to determine if taxes are applicable.

- If tax is applicable, the Tax Office will ask if the department wants to pay for the taxes (grossed up) or have the vendor pay for them (deducted):

- Grossed Up – The department will be charged for the tax amount, and the vendor will receive payment for the invoiced amount.

- Deducted – The department will be charged for the invoice amount, then taxes will be deducted from that amount, and the vendor will receive the difference.

- The Tax Office will advise you of the GL & Fund (no cost center used) for the tax expense line when creating the e-NPO. You must attach the Tax Office email indicating the tax implications to the e-NPO as support for the tax impact.

- If the e-NPO does not include the Tax Office email, it will be rejected.

Payment via Purchase Order

- Accounts Payable will route these invoices to the Tax Office for their review to determine if taxes are applicable.

- If there is no tax effect, the invoice will be processed for the billed amount.

- If taxes need to be withheld, the Tax Office will contact the department directly to determine if they want to pay for the taxes (grossed up) or have the vendor pay for them (deducted):

- Grossed Up – The department must increase the PO by the tax amount. The department will be charged for the tax amount, and the vendor will receive payment for the invoiced amount.

- Deducted – No PO adjustment is needed for this option. The vendor will receive payment for the difference between the invoiced amount and the tax amount.

AP Resources Web Updates (091019A)

The AP Resources webpage has been updated. New e-NPO Procedures are now posted and should be referenced when creating an e-NPO for vendor invoices, reimbursements, or refunds. The procedures also include information for using the e-NPO Monitor Report and dealing with e-NPO corrections.

A new resource defining How to Submit an Invoice has also been added. This link will guide you through the required information needed to comply with various State of Texas and university policies to process invoice payments.

Employee Reimbursement Certification Statement (072319A)

When reimbursing employees for expenses via the e-NPO process, the employee must certify the validity of the expenses and that they have not been reimbursed by any other means. If the employee seeking reimbursement is creating their own e-NPO, the document submitted in SAP will serve as the employee’s certification.

If an employee seeking reimbursement has someone else (e.g. administrative assistant) create the e-NPO on their behalf, the following statement (or similar language which includes the context below) with the e-NPO reimbursement amount stated must be attached:

- This email serves as my signature and validation of the $###.## in expenses listed on this e-NPO with the corresponding receipts attached. I certify that the expenses are correct, were paid with my personal funds, and have not been paid or reimbursed previously by the university nor by any other means.

The above statement template, also located on the e-NPOs webpage, is provided for your benefit and may save time in drafting a certification statement. Be sure to insert the reimbursement amount in the statement template. The person creating the e-NPO for the employee can email them the certification statement draft for review and to respond either "Approve" or "Agree." The email provides the date and email credentials for the person agreeing to the certification statement content. That email should be attached to the e-NPO. This is simpler than creating a Word document for the employee to sign, date, and scan back to the e-NPO creator.

Payment processing delays may occur should a different statement be submitted which does not include the required information and/or language similar to the template.

AP-12 Form Revised (041819A)

The AP-12 Form is used for authorization to purchase alcohol, flowers, food and/or refreshments (including employee only events). This RSS is in addition to RSS 100218B. Listed below are the most current changes.

-

Clarified the directions and the approval requirements.

-

Changed to a PDF document for easier completion.

-

Clarified instructions for approvals.

-

GL numbers added at the top of Section A.

-

Section B expanded for ease in entering a complete business purpose/explanation and for the names of the attendees.

-

Section C now has a separate selection for either Estimated Cost or Actual Cost.

The form can be found at AP Forms.

Purchase of Flowers or Plants for Events (041119A)

Until further notice, the purchase of flowers or plants for events will no longer require a breakout into flowers/plants, give-a-ways or rental of vases. In the past departments were required to advise whether the flowers were going to be thrown out or given to an attendee. If thrown out, the cost was expensed to GL733100 (Plants and Flowers), if given away the cost was expensed to GL 730900 (Promotional Items -Local Funds). If the florist indicated a “rental fee” for a vase that amount was expensed to GL 740600 (Rental of Furnishings and Equipment). If there was no vase rental and the vase was part of the floral charge, that amount was expensed to GL 733400 (Personal Property Furn/Equip/Other Expensed).

The overall purchase is for a centerpiece or arrangement (floral design) for an event and all will be expensed to GL 733100 (Plants and Flowers). The cost for the flowers or plants is part of the planned event expenses. If the event organizer decides to give them away rather than throw them out, that doesn’t change the cost of the event. If given away, it is not done to “promote Texas State University”, but just to get rid of them.

The florist can break out the cost for the “components” of the floral centerpieces or plants placed around the event; however, the florist was hired to provide the items. Therefore, we will not be going through the effort to determine what the event sponsor is charging for these. In effect, the university is having flowers or plants at the event for “ambience” and that total cost will be expensed to GL 733100.

Gifts and Tax Reporting (011019A)

Remember that if you are giving reportable gifts to non-employees, there may be tax reporting required. See RSS 063017A.

If tax reporting is required, a vendor record will have to be created in order to capture the gift amount. Prior to requesting from the recipient the information necessary to create their vendor record, you must determine which method will be used to obtain the information. The two allowable methods are:

- Use the Vendor Maintenance Form to obtain the appropriate information from the recipient (recommended method).

- If an IRS W-9 Form is preferred rather than the Vendor Maintenance Form, contact Vendor Maintenance with that request and rationale.

For questions regarding vendor setup, contact Vendor Maintenance in the Procurement and Strategic Sourcing Office at vendorrequests@txstate.edu or x5-2521.

AP-12 Form – Completing the Form (100218B)

The AP-12 Form is used for authorization to purchase alcohol, flowers, food and/or refreshments (including employee only events). Listed below is guidance on completing the form for payment processing.

-

Type of Payment – Select only one of the following: PO, P-Card, e-NPO or LBJ Chartwells IDT.

-

Purchase Order Number - PO number on the AP-12 must be the same as the one listed on the invoice and used to process payment.

-

Source of Funds – The Cost Center and Fund listed on the AP-12 is for processing the payment with the selected type of payment. This data must be the same as that on the PO or e-NPO.

-

Complete all sections of the form and obtain appropriate signatures.

The form can be found at AP Forms. Scroll down to the AP-12 form once you access this link.

Protecting Sensitive Information on Expense Reimbursements (061418A)

The Accounts Payable and Travel office requires receipts to reimburse qualified business expenses. Expenses can relate to routine department operations or travel for the university. Before attaching a credit/debit card receipt, a bank or credit card statement, or a cancelled check to the reimbursement document, please keep in mind the information below to protect your personal information.

- Credit or Debit Card Receipts - The full number should not be visible. Block out (can use a black marker or something similar to cover the data) everything except the last four digits.

- Bank or Credit Card Statements - Only the customer’s name and transaction for reimbursement should be visible. The account number, address, and all other transaction information should be blocked out. This option is only needed to support the expense if the receipt cannot be found and attached to the reimbursement request or travel expense report.

- Cancelled Checks - The employee’s name should be visible, but the employee’s address, bank routing number, and account number should be blocked out. This option is only needed to support the expense if the receipt cannot be found and attached to the reimbursement request or travel expense report.

Revised Request for Recurring Payments Form (052918A)

A revised Request for Recurring Payments form is now located on the PSS website. Click on the link provided in the prior sentence to access the form. The terms and conditions section of this form is vital for Accounts Payable to process payment on time as it includes the date ranges, amount to pay and payment due dates. The form must be attached to the purchase requisition for recurring payment to occur.

This form is required for any recurring payments such as car leases, office rental space, and Summer REU participants.

Do note that Summer REU purchase requisitions will need the completed form attached. As mentioned above, this will ensure that payments are issued to the individuals in that program per the timeline that was communicated to them.

Revised AP-3 Wire Transfer Request Form (042418B)

Due to an overwhelming increase in wire fraud, the banking networks have modified the information required on foreign wire transfers. Accounts Payable has updated the AP-3 Wire Transfer Request form used for these changes. The information sent to Texas State must come from the e-mail address on the vendor record in SAP. If the vendor needs to update their information, please have them contact Vendor Requests at vendorrequests@txstate.edu or (512) 245-2521.

It is important to remember that the vendor is responsible for contacting their bank to see what information is required for a wire to be processed to their account. Any missing or illegible information will cause delays in payment. Texas State cannot recall wires once they have been processed, so adherence to these requirements is critical.

The updated form and instructions are located on the Accounts Payable Forms webpage under Wire Payments.

If you have any questions, please contact Accounts Payable at 5-2777.

For travel-related wire payment questions, please contact the Travel Office at 5-2775.

Invoice Attached to PO (042318A)

Effective May 1, 2018, invoices for certain payments will no longer be sent to the departments after the payment has been processed in AP. Instead, the invoice will be attached to the PO so the department can readily access it as needed. The rationale for this process is that the account manager approval on the PO suffices for the approval on the invoice in these situations.

Currently, the types of invoices that will be attached are:

-

Amazon

-

Drinking water/dispenser rentals such as Ready Refresh or San Marcos Ice & Water

-

Subscriptions (when invoice amount equals the PO amount)

-

Registrations (when invoice amount equals the PO amount)

-

Recurring monthly charges when the invoice amount equals the monthly amount on the PO

-

Temporary Staff (time sheet has department approval)

The procedures for How to View an Invoice on a PO can be found on the View Vendor Invoice & Payment Activity webpage. These procedures differentiate the process between POs in SAP and those in Marketplace.

Vendor Numbers on Purchase Requisitions (042018A)

Please remember that it is never acceptable to use a vendor number that starts with a “6” that is six digits in length (e.g. 612345) on a purchase requisition. That number series is used for payee links tied to the main vendor record. For example, the payee link is used when another address (e.g. remit to address) is needed for sending check payments rather than to the main vendor address.

Remember there are some vendor numbers that start with a “6” that can be used on purchase requisitions. These numbers are NOT six-digits in length. Use the number of digits as the identifier between main vendor numbers and payee link numbers to help you with the selection of the correct vendor number on your requisition.

To avoid having your purchase requisition rejected for corrections, please update your procedures with a note that "6" payee link numbers (six digits) can never be used on purchase requisitions.

Local Food Vendors and Payment Process (040618A)

When dealing with local food vendors, please follow the following for payment options:

- If requesting a catering event, create the PO and send it to the vendor so all the requirements are clearly stated and there are no misunderstandings.

- Create a PO and take or send it to the vendor before the business meal so they have it on hand.

- Use your P-Card to pay for a business luncheon. You will need to obtain a P-Card Waiver to use your card at the food vendor.

- Personally pay for the business meal and seek reimbursement through the e-NPO process.

It is NOT appropriate to dine at a food vendor and leave the restaurant and the vendor to send the bill to the University. This puts the vendor in a precarious situation as non-employees have tried to have charges billed to the university and the vendor must absorb the loss if they let the party leave without payment. You must either have a PO that is presented (or already at the vendor) at the time you arrive at the restaurant to hold a meal or pay for it before you use. As mentioned above, catering events always require a PO as those are more involved than spontaneous business meals which typically involve the attendees ordering from the standard menu.

If the vendor is presented with a PO, they will submit an invoice to the University. The invoice should be emailed to payables@txstate.edu or mailed to:

Texas State University

PO Box 747

San Marcos, TX 78667-0747

The invoice must show “Bill To” as Texas State University with our mailing address (the above address or 601 University Drive in San Marcos, TX 78666). The invoice must contain the vendor’s name, address, invoice number, PO number, an itemized listing of the transaction, and a department name and contact. If the vendor uses the itemized cash-register receipt for the meal that is acceptable as long as the other information listed is provided either on the invoice or the email.

Please ensure the staff in your departments are aware of these payment options. Local vendors will be contacted to inform them of this process and that they can expect payment before the group leaves if a PO is not presented either before or at the time of the meal.

Revised AP-9 Form and Instructions (021518B)

A revised AP-9 (Student Organization Account Payment Request Form) is on the Accounts Payable website.

Cash Advance requests will not be processed unless a detailed explanation is provided under the Purpose of Payment section of the form. This explanation should be descriptive and provide specific information regarding the request. The section must also state that all receipts will reconciled to the advance amount and any unused funds will be returned to the club.

Section e.i. Cash Advances under ‘Allocation” on page 2 of the AP-9 Instructions has been updated. It is very important that the advisor approving the cash advance request and student receiving the advance read through the updated instructions to ensure they are aware of the requirements for which they will need to comply. The advisor, student, and club will be responsible for retaining itemized receipts, deposit tickets, and reconciliations.

The new form and instructions can be found at AP Forms. Scroll down to the AP-9 form and instructions once you access this link.

University Clothing Purchases (111717A)

A purchase order is required to purchase shirts or other articles of clothing whether for employees or students. A valid business purpose must indicate the rationale for the purchase (e.g. activity involving students, departmental identification for student or public benefit at an event).

The IRS treats the purchase of shirts for employees as a fringe benefit (taxable) unless the clothing is required as a uniform in the work environment or required for a specific function (e.g. commencement volunteer shirts).

IRS Publication 5138 (2-2014) explains that “the value of work clothing provided by the employer is not taxable to the employee if:

• The employee must wear the clothing as a condition of employment; and

• The clothes are not suitable for everyday wear” or are not adaptable to streetwear.

Purchase of shirts for employees, other than uniforms, typically requires Cabinet Officer approval.

• Obtain approval via email or the use of the AP-12 form (explain the rationale in the Comments Section) or via email. The rationale for the purchase must be clear so the Cabinet Officer can make an informed decision.

• Attach the approval to the purchase requisition.

The purchase of clothing (typically T-shirts) for students is allowed as part of the “student experience”. Students are not employees and the value of the clothing is considered de minimis.

e-NPO Correction Email Notifications (101217B)

The originator of an e-NPO may receive an email correction notification or rejection notification during the AP or Travel review of the payment request. It is imperative for you to respond to the notification upon receipt. Refer to the bottom of the email received for the time allowed to respond as there are different timeframes as explained below.

An e-NPO email correction notification is sent to the originator if additional information is needed (e.g. valid business purpose, attach correct documentation, or for a Travel e-NPO the Traveler Certification Statement may be needed) but it is not necessary to restart the workflow. The originator has seven (7) days from the day the email is sent to respond to a correction.

If not complete in the allowed time the document will be rejected, returned to the workflow for approval and an email rejection notification will be sent to the originator. The originator has 14 days from the date of the rejection notification email to respond. If not complete in the allowed time the document will be deleted. The originator must then create a new e-NPO.

Informing Accounts Payable & Travel of Budget Corrections (101217A)

The Accounts Payable and Travel staff may not be able to process a payment request due to a budget error. The person processing the payment request will email the originator to resolve the issue. When the requested update is complete, the originator must email the response to the requestor (AP or Travel staff person). This is very important so payments are not delayed any longer than necessary.

Revised Instructions, FBL1N - Vendor Payment Block (071717A)

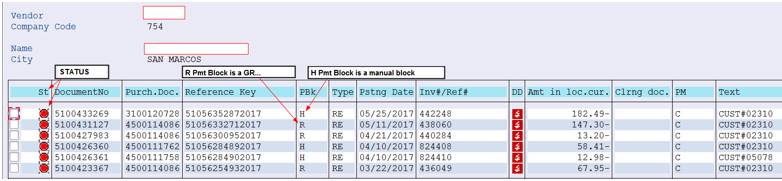

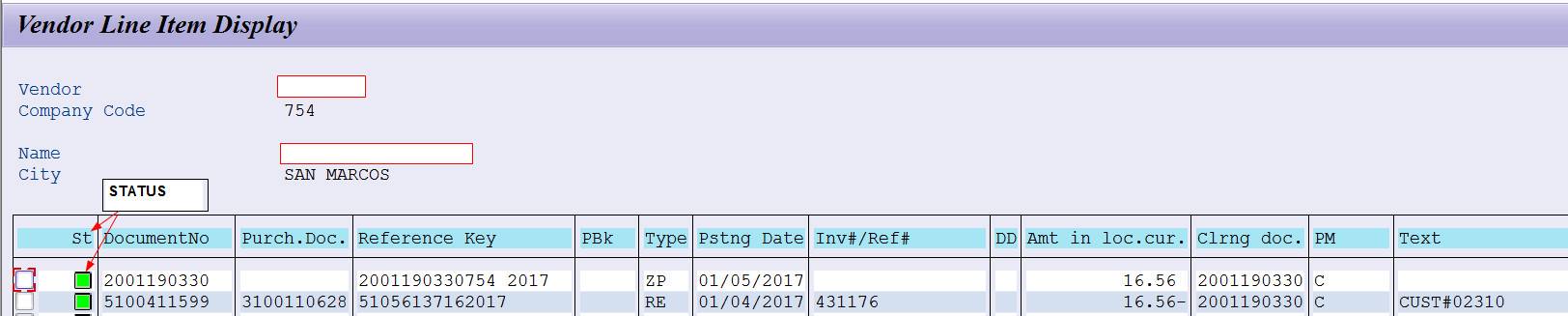

When checking for the vendor payment status, look at the "Vendor Line Item Display" (SAP T-Code FBL1N). Do keep in mind that the payment to the vendor may not be released even though the charge is included in your Budget To Actual Report. When a payment has been posted (red status), it is ready to pay unless there is a payment block (PBk).

When an H is in the payment block field, as seen below, a manual block was applied. The Accounts Payable office will release the payment when the department has sent the requested information.

When an “R” is in the payment block field, a GR (Good Receipt) is required and should be completed in SAP for payment to be released.

When the payment has been sent to the vendor (released), the status will be green on the FBL1N screen.

For more information, review the Accounts Payable FAQs on How do I search for an invoice payment in SAP (T-code FBL1N).

Non-Employee Awards, Prizes or Gifts (063017A)

At times, it is necessary to issue awards, prizes, or gifts to non-employees. These items are valued at their purchase price. Personalized items less than $100 are valued at zero.

Awards, prizes, or gifts to non-resident aliens have no de minimis threshold and any item valued at $.01 or more is reportable. Contact the Office of Payroll and Tax Compliance before proceeding if a non-resident alien has been selected to receive an award, prize, or gift.

Gift cards, including Bookstore gift cards, are not an approved form of payment to non-employees for any of these reasons. They are treated as cash payments to the recipient per the IRS and must be reported regardless of the amount (i.e. no de minimis threshold for exclusion).

Awards, Prizes, or Gifts Purchased from a Vendor

The issuing department must provide the following information to Accounts Payable for awards, prizes, or gifts with a cumulative value of $100 or greater. If several items will be awarded that cost less than $100 each, but the total value is more than $100, the following rules apply.

- A valid business purpose, e.g. non-paid guest speaker, contest winner, etc.

- The recipient’s SAP vendor number (if established in SAP) or a Vendor Maintenance Form that includes the recipient’s permanent address and tax identification number (typically the Social Security Number). If you want to use the IRS W-9 form to obtain this information from the recipient, contact Vendor Maintenance at x5-2521.

- Awards, prizes, or gifts purchased from a vendor should be expensed to GL 730900-Promotional Items. The recipient info as per the above is required to capture the value for IRS reporting.

- Items given with a value less than $100 are considered de minimis and do not require a vendor record setup as there is no tax reporting.

- The Athletics Business Office will monitor all athletic-related non-employee awards, prizes, or gifts presented to each recipient. Recipients who receive $600 in a calendar year must be reported annually to Accounts Payable for 1099 reporting. A vendor record will need to be created (or updated) for each recipient as defined for Athletics.

Cash Awards, Prizes, or Gifts Paid to a Recipient Via Check or Direct Deposit

- The recipient must be set up as a vendor in SAP. Payments cannot be made using the 700001 vendor number.

- The payment will be expensed to GL 770001-1099 Awards.

- The issuing department must provide a valid business purpose, e.g. non-paid guest speaker, contest winner, etc. If the award or prize relates to an on-campus contest, attach a scanned copy of the flyer detailing the contest details (what, when, where, and how the winner was notified and selected) to the payment request. If there is no flyer announcing the contest, a summary of the event that the prize/award relates to must be attached to the payment request. This is required whether payment is to the recipient or to the vendor from which the prize is being purchased.

Victory Cleaners PO and Payment Process (060717A)

Effective immediately a standardized process has been developed with Victory Cleaners. The process is as follows for services at the cleaners:

- The department staff will create a PO for the services required from Victory Cleaners. Use GL number 727700 on the PO.

- The staff member dropping off an item(s) should provide their name, the PO number (or the PO form), and their department name to Victory Cleaners.

- Victory Cleaners will include the PO number, staff and department name on each invoice.

- Victory Cleaners will use a single invoice format and will email all invoices to Accounts Payable at payables@txstate.edu rather than mailing or emailing invoices to the various campus departments.

- This will assist Victory Cleaners so they only have to maintain a single invoice format and email address for sending invoices to the university.

- This will standardize the process as per the instructions on the PO provided to the vendor and eliminate the unrealistic burden for the vendor of providing various billing format notices and sending to many different email addresses.

- If the department does not have a PO, then they must either pay with a P-Card OR request that an invoice be emailed to payables@txstate.edu with “NPO” as the PO number. The name of the staff member who will drop off or pick up the item(s), and department will still be provided to Victory Cleaners in this situation and that will be included on the invoice. Accounts Payable will send the invoice with NPO listed in the PO number field to the department listed on the invoice. That department staff will create an e-NPO for the charges using GL 727700.

- If paying by P-Card, there is no further action required with the vendor. However, the vendor will provide a receipt which should be retained for supporting documentation on the P-Card charge/log. The expense for the services will appear in the department’s GL 727700 when the P-Card transactions are processed.

- DO NOT create a PO after the fact. Follow step #5 if there isn’t a PO.

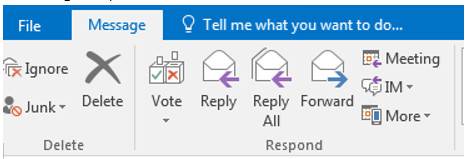

Outlook Voting Process (030117B)

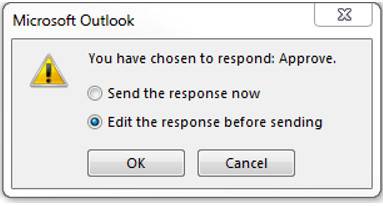

Accounts Payable is now using the Outlook Voting Buttons as an alternative method for responding to email requests for action in order to issue payments on vendor invoices. You can still respond the way you always have, but if you find the Voting Option quicker, then please use that.

The Voting Option works as follows:

AP will use OUTLOOK Voting for automatic responses.

-

You will see the following under the subject line:

![]()

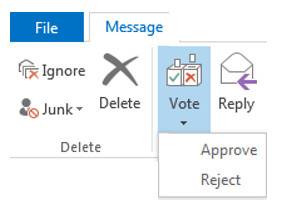

- From the Message tab, click the “Vote” icon:

-

Select “Approve” or “Reject,” then select “Send the response now”. Outlook sends the response to the AP staff who sent you the original email.

-

To add a service completion date, select “Edit the response before sending” and enter the date in the email body before you send the response.

-

If a PO adjustment is required, “Vote” and select PO ADJ DONE.

-

If forwarding the original AP email to someone else in your department, the original sender from AP must be copied to ensure the “voting” response is received. If the original AP staff is not copied, the “voting” response will only go to the person who forwarded the email. It will not be received by AP and payment will not be processed.

Invoice Payment Notification Process (030117A)

Effective March 1, 2017, Accounts Payable will only send ONE email notification requesting action in order to process an invoice received for payment. This notification will be sent with one of the four following subject lines:

SUBJECT LINE: REQUEST FOR COMPLETION DATE AND DEPART APPV- AP FINAL NOTICE: INVOICE ###### PO ##########

SUBJECT LINE: REQUEST FOR PO CORRECTION- AP FINAL NOTICE: INVOICE ###### PO ##########

SUBJECT LINE: REQUEST FOR INVOICE RECEIVED DATE – AP FINAL NOTICE: INVOICE ###### PO ##########

Emails will be sent to the departmental contact and your action/response should be completed within 7 days. Delays can result in unnecessary interest expense if the University does not comply with the State of Texas Prompt Pay Act.

- AP will include a screen shot of the invoice in the email body. This will make the request for action and the invoice easily visible when the recipient opens the email. Hopefully that will aid in quickly responding to the request. NOTE: If the invoice has several pages, it will be attached to the email rather than included in the email text.

- The Account Manager and department will be determined from the account information and the PO requisitioner/creator.

- If you are disputing an invoice, email the vendor within 21 days of the invoice receipt and advise AP of the dispute. Once the dispute has been resolved, documentation of the dispute and resolution must be provided to AP before payment will be issued. If a new invoice is required, ensure it has been provided by the vendor and inform AP so it can be noted on the original invoice.

- AP will direct calls from vendors to the responsible department if payment is delayed (i.e. no response from the department).

Please note that no changes will be made to the following types of invoice payments as they are paid if the invoice matches the PO.

-Temporary Agencies-Memberships & Renewals-Licenses

-Ready Refresh-Service/Maintenance Agreements -Amazon

-Subscriptions

Temporary Staffing Agency POs (111816A)

It is no longer required to enter a name for the temporary staff position hired through the Marketplace. The vendors for temporary staffing in the Marketplace are PRIORITY PERSONNEL, INC. and KEYSTAFF, INC.

The process for creating a PO for temporary staff is as follows:

-

Always access the Markeplace to create the PO.Never create a “45” PO in SAP.

-

When entering a Catalog Order for listed positions, use the position title in the catalog.You will not be able to enter a name.

-

If someone specific has been identified for this position and that is the only person you want to fill the position, email Purchasing to update the PO to include the temp’s name on the PO.

-

-

Catalog hourly rates (base/mid/max) will be used for pricing.

-

Email purchasing@txstate.edu to request a line on the PO for anticipated overtime per position.

-

If you can’t find the position you need to hire, you must first obtain pre-approval from HR (Lynn Ann Brewer).

-

Email purchasing@txstate.edu with a request for position.

-

Purchasing will then review the request and send it to HR for review/approval to determine base, mid, and max hourly rates.

-

After HR approval has been obtained, new position titles can be added to the catalog, and Marketplace PO can now be created.

-

EXAMPLES

-

Warehouse Worker is a catalog position title, but Res Life Warehouse Worker.

-

Use “Warehouse Worker” on the PO; temp staff name cannot be entered.

-

-

Medical Doctor is a non-catalog position.

-

HR approval is required.

-

After HR approval has been obtained, new position titles will be added to the catalog, and Marketplace PO can now be created.

-

PAYMENT PROCESSING

-

Timesheets are approved weekly and sent to the agency.

-

If the department wants the hours (payment) applied to a particular PO line, write the PO line number on the timesheet.

-

This may occur when there are multiple lines for the same position.

-

-

Timesheet approval serves as invoice approval and payment authorization.

-

AP receives the invoice with timesheet attached.

-

The PO data is matched to invoice data.

-

The approved timesheet is balanced to the PO rate and hours on the invoice.

-

If the timesheet indicates the PO line which to apply the hours, that will be done.If not, AP will apply the hours to the first line on the PO with the same position title and rate as on the invoice.

-

Overtime charges will be applied to the appropriate line by position or line number if indicated on the timesheet.

BENEFITS

-

One PO line can be created for multiple temp workers with the same position and rate. (e.g. 6 warehouse workers for 240 hours). Note: a new PO is needed when hours are all used.

-

Don’t have to cancel the PO line and create a new PO when a temp staff is reassigned or replaced by the agency.

Timesheet position title, rate, and hours matched to PO and invoice by AP and paid.

Grants Commonly Used GL Accounts - Update (092216A)

The Grants Commonly Used General Ledger Account numbers have been updated to assist you with proper coding of Grant expenses on Purchase Requisitions and e-NPO’s. GL 720202 can now be used for membership expenses paid for participants (posts in the Participant Support sponsored class). GL 720100 is used for all other memberships (posts in the Supplies and Materials sponsored class).

Select this link to reference the Grant GL Accounts as needed. http://www.txstate.edu/gao/ap/resources/GL-Codes.html

If you do not see the expense definition on the Grant GL Account list then click on the link at the bottom of the Grants Commonly Used GLs or go to the AP Commonly Used GLs at http://www.txstate.edu/accounts-payable/resources/AP-Commonly-Used-GLs to access other commonly used expense GL accounts.

Conference PO General Ledger Numbers (090216A)

Effective immediately for any new POs created for conferences, expenses must be encumbered in separate General Ledger (GL) accounts rather than all in GL 721300. The reason for this is to comply with IRS reporting of rental payments and university travel reporting.

The GL accounts that must be used to capture expenses are as follows:

Conference Expenses

- Rental of Space - GL 747000 or 746200

- Rental of Furnishings and Equipment - GL 740600

Audio Visual Equipment, laptops, podium, dry erase boards, etc.

- Lodging to the correct travel GL’s based on whether the location is in-state or out-of-state

Can combine room rate and tax to the same GL

Different GL’s used for Staff, Participants and third-party (presenter) lodging

Excess Lodging must be broken out (not typical for conferences)

- See the Travel GL’s at Travel GL Matrix

- Other conference charges – GL 721300

Meals and Catering, copies, other miscellaneous expenses

If you have any questions, please contact the Procurement & Strategic Sourcing Office at 245-2521.

e-NPO Payment Processing Time-Frame (051216A)

When requesting an e-NPO payment from the Accounts Payable or Travel departments allow 10 business days for payment processing. If a Rush Payment is required, send an email to payables@txstate.edu or travel@txstate.edu with the document number and RUSH PAYMENT in the subject line. Include the date the payment is needed in the body of the email.

For timely payment processing ensure the following requirements have been meet.

- The business purpose should be descriptive enough to clearly answer any questions regarding the purpose of the business expense, and the benefit to Texas State. (e.g. “60 Clear Sterile Vials for Aquifer test samples”, NOT “Supplies for Research” or “Research”).

- Attach the invoice for payments to vendors.

- Attach all itemized receipt(s) and other documentation for employee reimbursements.

- Credit card receipts that do not provide an itemized breakdown are not acceptable.

- Documentation must include a detailed invoice, sales ticket, receipt, or comparable confirmation from the vendor that the expense was incurred. (FSS/PPS No. 03.16 Sec. 03.02)

- For Travel Payments, you must include the Approved 10-digit Trip No. beginning with 73000 for Travel Tracks and 201455 for Funds Commitments.

- For employee or student lodging payments, attach the hotel confirmation or folio that specifies the person(s) staying, trip date(s), and room and tax amount. Texas State University is tax exempt from the State of Texas Occupancy Tax. When paying a hotel within the state of Texas, the vendor must provide a breakdown of any taxes charged (e.g. Entertainment, County, City, etc.). Validate there are no State of Texas Occupancy Taxes included. If the tax is included, provide the Texas State Hotel Occupancy Tax Exemption form to the hotel, obtain a revised confirmation or folio and then submit the e-NPO. Non-employees who personally pay for lodging can be reimbursed for this tax. However, if the department is booking the room, they should provide the exemption form to the hotel since the university is making payment directly.

- For lodging payments, attach a copy of the gsa.gov per diem table applicable to the over-night lodging destination.

- Obtain and attach the appropriate certification statement.

AP-2 Upload File Certification (012916A)

The preparer of an AP-2 upload file has the responsibility to ensure the vendor information on SAP (name and address) is correct and matches the intended payee data (i.e. paying the correct person). This should be done before the file is submitted to the PI for approval.

The AP-2 Upload Form has been revised in Section 4 for this certification. The upload file preparer should sign the line provided when the SAP data has been validated.

The form is available at: http://www.txstate.edu/gao/ap/forms.html.

Invoices without PO Numbers (010816B)

As mentioned at the October 27th Bobcat Buyers Meeting, invoices received for payment without a PO number will be returned to the vendor by Accounts Payable and considered as disputed until the vendor provides a revised invoice with the PO number included.

Please ensure that when you are placing an order with a vendor you provide a PO number and remind them to include the number on the invoice. This will minimize the impact or delay they may experience if they provide an invoice without a PO number for payment. As vendors become more aware of the PO number requirement, they may request the PO number before accepting the order.

Change in Account Manager Approval Process (082715A)

Effective IMMEDIATELY there is a change regarding Account Manager (AM) approval when a Purchase Order (PO) has been completed and approved.

If no Goods Receipt (GR) is needed, Accounts Payable is allowing approvals by departmental staff rather than requiring AM approval on the invoice. Without a GR, the only way to confirm payment for the invoice detail is for a member of the departmental staff to approve it. The departmental staff is not approving the expenditure, but is verifying the service is accurate, complete, etc. The AM approved PO is now sufficient authorization of the expenditure of funds. When no PO exists to document the AM approval of the change, the e-NPO workflow process obtains proper AM approval.

Processing Business Meal Invoices for Catered Events (070215A)

When creating a purchase order and approving an invoice for a business meal provided by a caterer, keep the following in mind:

- Create a purchase order (PO) for the event when meals in conjunction with official Texas State business are provided by a caterer.

- Include the business purpose on the purchase order and be as specific as possible. If you do not include the business purpose on the PO, then you must be include on the invoice prior to submitting to Accounts Payable for payment.

- A list of participant names and identification as either employees of the university, external attendees, or students is required if there are 19 or fewer participants. If 20 or more participants are in attendance then a general description of the attendees is required. Attach the list of attendees or general description as appropriate to the PO. If this information is not attached to the PO you will need to provide it with the approved invoice for payment.

- Give the vendor the PO number when placing the order and ask that the number be included on the invoice. This will help Accounts Payable identify where the invoices should be applied when received.

Select the following link for additional guidelines for Business Meals FSS/PPS 03.11.

Non-Tax Exempt Business Meal Purchases (060515A)

When business meals are purchased with a personal credit card or with cash by an agent or employee of Texas State, the meal is considered an item of a personal nature, even if the meal will be consumed in conjunction with official Texas State business. The agent or employee may not present a completed Sales Tax Exemption Certificate to the merchant to claim a sales tax exemption. Because the Texas State agent or employee is unable to avoid payment of the sales tax, the sales tax is considered a valid business expense and may be paid or reimbursed to the agent or employee at the discretion of the account manager.

When meals in conjunction with official Texas State business are to be purchased by an agent or employee with a purchase order (invoice billed and mailed to the University), a direct payment form (e-NPO with the merchant as the vendor), or a P-card, the meal is considered to be sales tax-exempt since University funds will be used for payment. The agent or employee must present a completed Sales Tax Exemption Certificate to the merchant to avoid paying sales tax.

On-Line Purchase Documentation (110514A)

At times it is necessary to purchase an item or register for a conference, etc. on-line related to a valid business purpose. When an employee does this, he/she may seek reimbursement from the university. It is important to obtain the proper documentation to support this on-line purchase. Please follow one of the steps below to ensure this documentation is available for attachment to the e-NPO for the employee reimbursement:

- Print a screen shot showing the purchase.

OR

- Print the on-line purchase confirmation which is usually provided on these types of purchases.

Either one of these options will have the required payable information showing the name of the vendor, person making (paying for) the on-line purchase as well as what was purchased and the cost.

When completing the e-NPO, attach this information and be sure the business purpose section is defined on the entry screen.

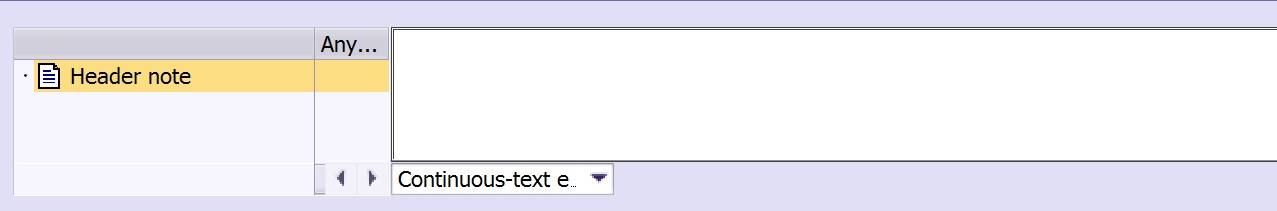

Invoice Contact Information on SAP Purchase Requisition (110414B)

On an SAP Purchase Requisition, you can enter the contact person’s name, netID and telephone extension in the Header Note area to assist Accounts Payable should they need to contact your department about a question. This must be the first entry in this note area.

The Header Note is only viewed internally and doesn’t print on the PO. AP will check the Header Note for routing invoices requiring approval or action (Goods Receipt).